Manual for Those with a Dollar and a Dream

I knew as a child that my family lived a paycheck-to-paycheck life, so I learned at a young age to be financially independent. It is no secret that lower-income students like myself are much less prepared for college than higher-income students. For many low-income students, college can be an intimidating step, and we sometimes don’t feel we belong. Not everyone who attends college has parents supporting their every college expense. Not everyone is comfortable with the idea of openly discussing their need for financial aid. Not everyone is familiar with the best loan and or payment options in order to avoid pre-registration frustrations.

Even with our best efforts, it can be hard to maneuver college with lack of resources and little financial literacy. But you need to know that there is help on campus to ensure academic and financial success in college.

– Vea Molitika

Though there is the pressure to succeed in school and meet financial obligations, it is important to understand that resources are available to help ease the transition. Many of us have to work to pay our college expenses. And we learn quickly the importance of balancing school and work.

I was fortunate enough to find a job in retail down the street from Arcadia during my sophomore year, after consistently applying for jobs around Glenside and at Willow Grove mall. With every new semester, my work schedule changes to accommodate my class times. I currently work 35 hours per week and am in school as a full-time student. From experience, managers do understand that school comes first and are willing to accommodate your schedule, but you have to keep in mind that they’d rather you communicate one or two weeks in advance for change of work hours. Communication is key!

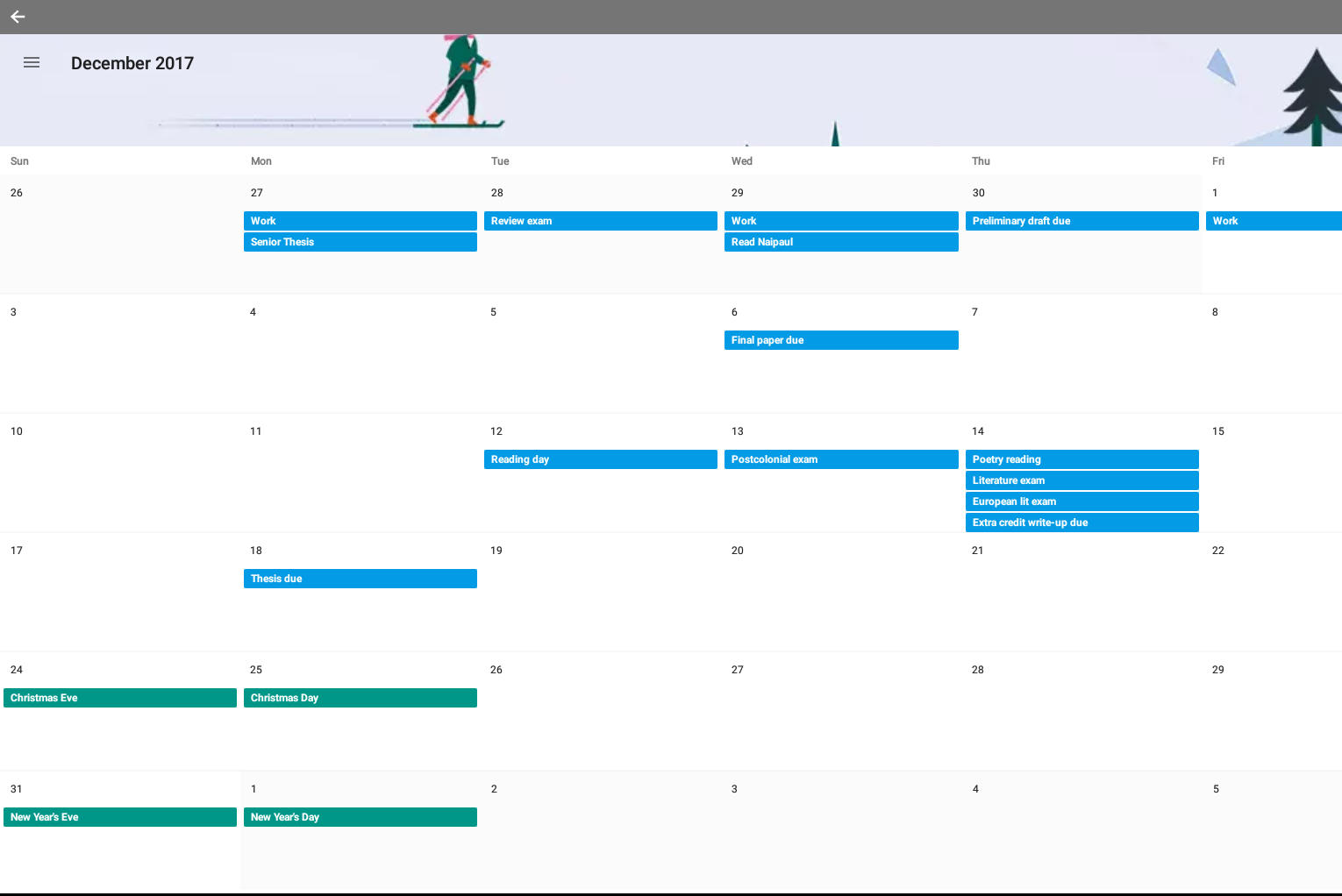

There are times when the line that marks balance blurs and stress sets in. You yearn for a day or two to rejuvenate and re-prioritize your life, but assignments pile up and customers are consistently rude at work. Those days seem unending— you’re tired, you have to close at work every other night so you can get home to finesse a paper for class that is due the next day. It took a while, but I finally learned the art of managing time by keeping a planner, as cliched as that may sound. I use Google Calendar because I find it easier to organize due dates, work times, exam and project dates, and leisure time online. From there I can map out visually what days are busiest. For example here, I have put in my schedule for December. Sunday is usually my day off, so I plan to spend that day doing school work for the following week. Visually, I can see that December 14 will be busy, so I have made a note that I will request December 13 off from work to study. It is important that I request this a week in advance so my manager has time to change the schedule accordingly.

After a long day at work, I do not feel like doing any school work. Therefore I know to get any school-related work done in the morning because that is when I have the most energy. At night, I prefer to unwind before bed by reading a book (NOT class readings) or writing poetry. Balancing work and school also means caring about the self, mentally and physically. I set aside time to hang out with friends, as well as alone time for myself so I can rejuvenate and regenerate for more work and school. Make time for the simple things like catching up on sleep, watching a movie, or calling home to check on family.

And always remember that you are in college to get a degree, not to work overtime in retail. We can’t let work interfere with school, but also vice versa. I always knew I was responsible for getting my assignments in on time, and work was not an excuse. I also knew I couldn’t lose my credibility at work by repeatedly calling out or being late. School was not an excuse.

Even with our best efforts, it can be hard to maneuver college with lack of resources and little financial literacy. But you need to know that there is help on campus to ensure academic and financial success in college. Here are a few important tips:

- Bother your financial-aid counselor as much as you need to. They are there for a reason. Your counselor will help you figure out options for how to pay your tuition. Scholarships, loans, and work study are some of them.

- Enroll in work study if you can. It’s convenient since most work-study positions are on campus. And it can only help your resume.

- Stay in touch with your academic advisors as much as possible. They will help you make sure you’re progressing academically and on track to graduate.

- Attend at least one Common Cent$ workshop per semester. You’ll leave with great financial literacy tools to make better financial decisions. Topics covered include banking and identity theft. Courses on taxes and student relationships with money will be offered in the spring.

- To help with balancing school and work, take advantage of Student Health Services. Make an appointment to talk with a counselor about college and non-college life as catharsis or pop in for a 30-minute de-stress fest in the Relaxation Room (massage chairs, coloring sand, and more!). Did I already say self-care is key?

Despite the burdens of balancing school and work, college can be all we want it to be. Being a low-income student doesn’t have to be a struggle. We want to (and can) experience the highs of collegiate life just like everyone else. #wedobelong!

Header image by Remi Frisby.